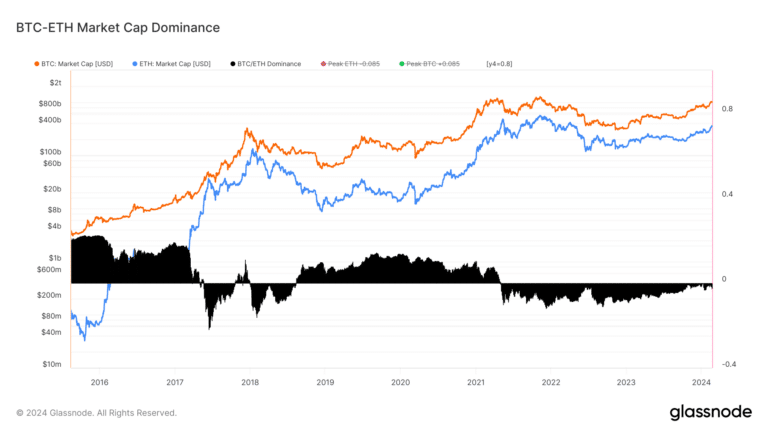

As ethereum to bitcoin price takes center stage, this overview invites you to dive into a fascinating landscape of two leading cryptocurrencies. While Bitcoin remains the pioneer of digital currencies, Ethereum has emerged with unique features that enhance its utility beyond mere transactions. Together, these cryptocurrencies have shaped the financial landscape, with their evolving prices reflecting a multitude of factors and market sentiments.

This discussion will explore the current price dynamics between Ethereum and Bitcoin, their historical movements, and the various elements influencing their values. We’ll also look ahead to potential future trends that could impact investors and users alike.

Overview of Ethereum and Bitcoin

Ethereum and Bitcoin are the two leading cryptocurrencies in the digital finance landscape, yet they serve distinct purposes and operate on different principles. Bitcoin, created in 2009 by an anonymous entity known as Satoshi Nakamoto, is primarily designed as a digital currency and a store of value. In contrast, Ethereum, launched in 2015 by Vitalik Buterin and others, extends beyond mere currency; it is a platform for decentralized applications (dApps) and smart contracts.

Both cryptocurrencies have unique features that drive their adoption. Bitcoin is lauded for its security and scarcity, operating on a proof-of-work mechanism that ensures transaction integrity. Ethereum, on the other hand, enables developers to build applications on its blockchain, generating a wide range of use cases from finance to gaming. Key milestones in their histories include Bitcoin’s first recorded transaction in 2010 and the launch of Ethereum’s mainnet in 2015, which propelled the concept of decentralized finance (DeFi) into the mainstream.

Current Price Trends

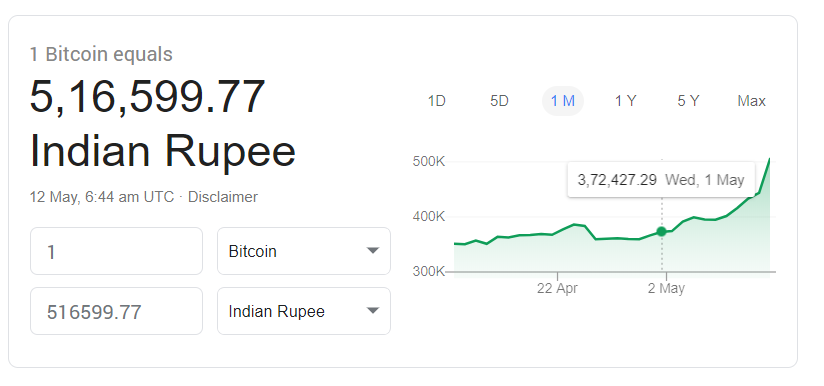

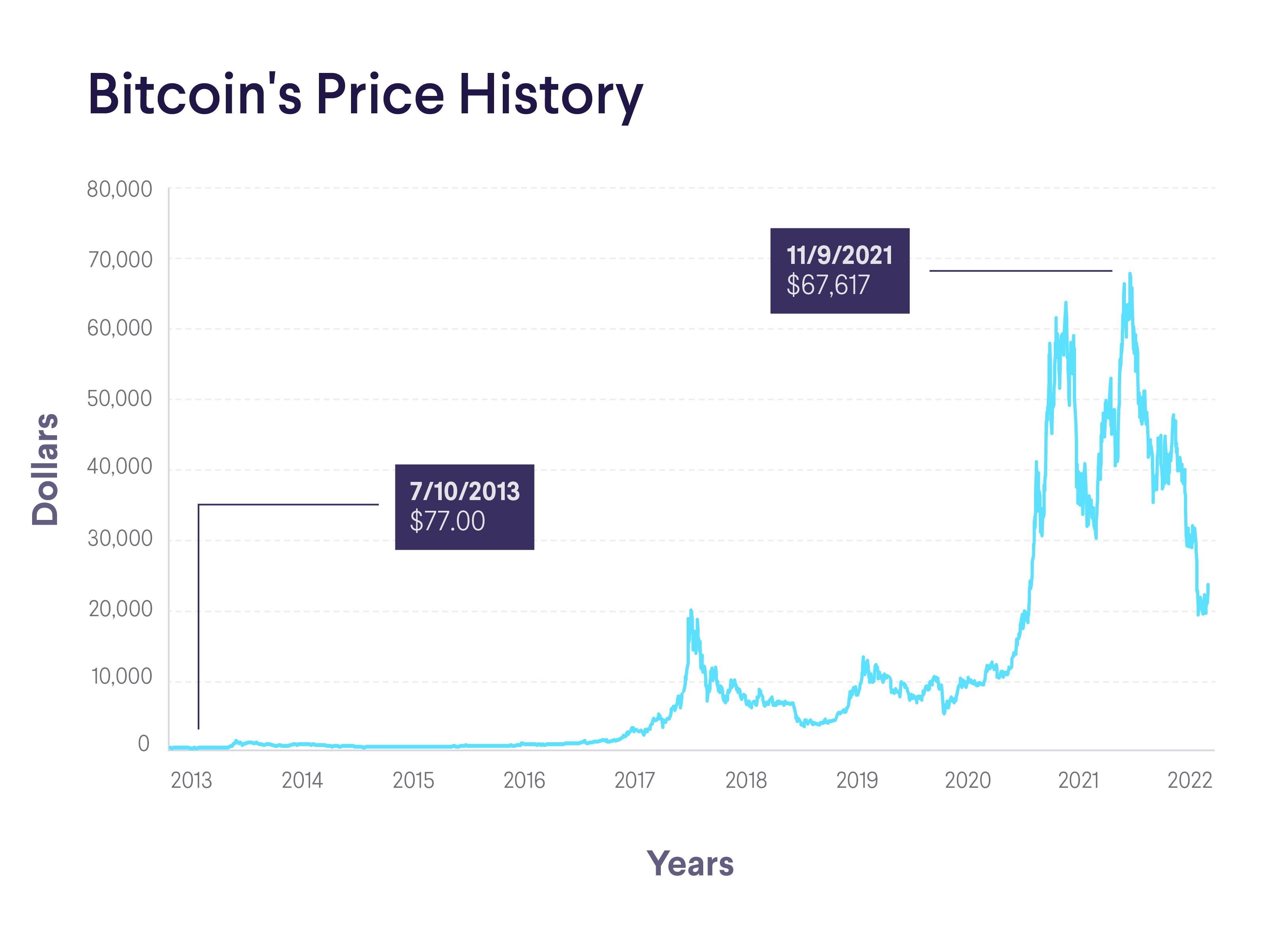

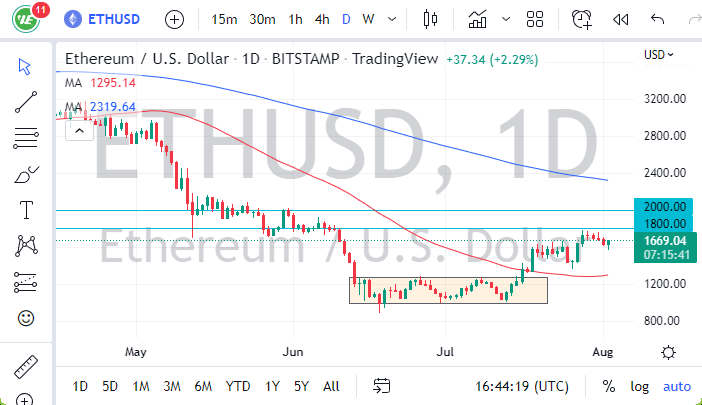

As of now, the price of Ethereum is significantly lower than that of Bitcoin, with Ethereum trading at approximately 15% of Bitcoin’s price. This relative valuation fluctuates based on market dynamics and investor sentiment. Over the past year, both cryptocurrencies have experienced notable volatility, with Bitcoin reaching an all-time high of around $69,000 in November 2021, while Ethereum peaked at about $4,800.To illustrate the price movements more clearly, below is a comparison table showcasing price fluctuations over various timeframes:

| Timeframe | Bitcoin Price Change (%) | Ethereum Price Change (%) |

|---|---|---|

| Daily | ±2.5% | ±3.1% |

| Weekly | ±7.0% | ±9.5% |

| Monthly | ±12.0% | ±15.0% |

Factors Influencing Price Changes

The volatility in the prices of Ethereum and Bitcoin can be attributed to various economic and market factors. These include changes in investor sentiment, global economic conditions, and news events that can sway public perception. For instance, regulatory announcements often lead to immediate price adjustments, reflecting the market’s reaction to perceived risks or opportunities.Major events such as the launch of Bitcoin futures in late 2017 and Ethereum’s transition to a proof-of-stake system in 2022 have had profound impacts on pricing.

These events demonstrate how technological advancements or regulatory changes can influence investor confidence and market behavior.

Price Prediction Models

Several methods are utilized to forecast the price of Ethereum in relation to Bitcoin, including technical analysis and machine learning models. Technical analysis relies on historical price data and chart patterns to predict future movements. On the other hand, machine learning models incorporate various datasets and market indicators to generate predictions.The following table compares different prediction models and their accuracy rates:

| Prediction Model | Accuracy Rate (%) |

|---|---|

| Moving Average | 65% |

| ARIMA Model | 70% |

| Machine Learning Algorithm | 75% |

Investment Strategies

Investing in Ethereum against Bitcoin requires a thoughtful approach. Various strategies can be employed, including direct trading, hedging, and diversification. Arbitrage, whereby investors capitalize on price discrepancies between exchanges, also plays a crucial role in trading strategies.To minimize risks while trading these cryptocurrencies, consider the following tips:

- Conduct thorough market research before making trades.

- Utilize stop-loss orders to limit potential losses.

- Diversify your portfolio to spread risk.

- Stay updated on market news and trends.

- Engage in regular performance review of investments.

Community Insights

The cryptocurrency community often shares diverse perspectives regarding the price dynamics of Ethereum and Bitcoin. Influential figures in the crypto space have expressed optimistic views about Ethereum’s potential to outperform Bitcoin in the future. For example, Vitalik Buterin has emphasized Ethereum’s scalability and versatility in various applications. Feedback from community forums reflects a general anticipation for Ethereum’s price movements, with many expressing belief in its long-term growth potential due to its expanding use cases and underlying technology.

Regulatory Impacts

Regulations significantly influence the price of Ethereum and Bitcoin, often in different ways. While Bitcoin is seen more as a digital gold, Ethereum’s categorization as a utility token subjects it to varied regulatory scrutiny. Government announcements, such as those concerning taxation or the legality of cryptocurrencies, can lead to market fluctuations, affecting investor confidence.Examples of regulatory actions include China’s crackdown on cryptocurrency mining in 2021, which caused significant price dips across the board, impacting both Bitcoin and Ethereum.

Future Outlook

Potential future developments, such as Ethereum’s upcoming upgrades and Bitcoin’s adoption as legal tender in certain jurisdictions, are set to influence their price dynamics. Technological advancements, such as Ethereum’s transition to a proof-of-stake mechanism, aim to improve scalability and sustainability, which could enhance its market position.The following table Artikels potential scenarios and their predicted impact on price movements:

| Scenario | Predicted Impact on Price |

|---|---|

| Increased Institutional Adoption | Bullish for both |

| Major Regulatory Restrictions | Bearish for both |

| Technological Upgrades in Ethereum | Bullish for Ethereum |

Conclusive Thoughts

In conclusion, understanding the interplay between ethereum to bitcoin price is crucial for anyone interested in the cryptocurrency market. The factors influencing these prices are complex, with technological advancements and regulatory developments playing key roles. By keeping an eye on these trends and employing strategic investment approaches, traders and investors can navigate this dynamic landscape more effectively.

Common Queries

What is the current price of Ethereum compared to Bitcoin?

The current price of Ethereum typically fluctuates based on market conditions, but it is often presented in comparison to Bitcoin’s price for clarity.

How do market trends affect the price of Ethereum and Bitcoin?

Market trends can significantly influence prices through investor sentiment, news cycles, and economic indicators relevant to both cryptocurrencies.

What are some key factors that influence Ethereum’s price relative to Bitcoin?

Factors include technological developments, regulatory news, market speculation, and broader economic conditions.

What investment strategies can be employed when trading Ethereum against Bitcoin?

Strategies include arbitrage, technical analysis, and risk management techniques to minimize potential losses.

How have historical events shaped the price relationship between Ethereum and Bitcoin?

Historical events such as regulatory announcements, technological upgrades, and market crashes have all played pivotal roles in shaping price dynamics.

![🔥 [60+] Ethereum Wallpapers | WallpaperSafari 🔥 [60+] Ethereum Wallpapers | WallpaperSafari](https://cdn.wallpapersafari.com/3/26/0EI8WN.jpg)