With eth usd crypto market forecast at the forefront, this dynamic landscape beckons both seasoned traders and curious newcomers alike, eager to understand the intricate dance between Ethereum and the US dollar. In the ever-evolving world of cryptocurrency, Ethereum plays a pivotal role, influencing market trends and valuations that resonate throughout the digital finance ecosystem.

As we delve into the nuances of ETH and USD, we will unpack historical performance, technical analyses, and the fundamental factors that shape their relationship. Get ready to explore the complexities and opportunities that lie ahead in the eth usd crypto market.

Overview of ETH and USD in the Crypto Market

Ethereum (ETH) and the US Dollar (USD) are two of the most significant assets in the cryptocurrency market. Ethereum, with its robust smart contract capabilities, not only serves as a digital currency but also facilitates a multitude of decentralized applications (dApps). USD, as a benchmark fiat currency, plays a crucial role in establishing the value of cryptocurrencies in the global market.

Currently, the market trends show a fluctuating relationship between ETH and USD, influenced by various factors such as technological advancements, macroeconomic indicators, and regulatory developments.The current market trends indicate a growing adoption of Ethereum across various sectors, leading to increased demand and, consequently, a rise in its valuation against the USD. However, volatility remains a consistent aspect of the cryptocurrency landscape, significantly impacting ETH’s price movements.

Key factors influencing the ETH/USD exchange rate include network upgrades, investor sentiment, and broader economic conditions.

Historical Performance of ETH/USD

Over the past five years, the ETH/USD exchange rate has experienced significant fluctuations. In early 2018, ETH reached its all-time high near $1,400, driven by heightened investor interest in blockchain technology and initial coin offerings (ICOs). However, the market faced a severe downturn, with ETH prices plummeting to around $80 in late 2018. This volatility was largely influenced by regulatory scrutiny and a general market correction.Key events impacting the ETH/USD price historically include the launch of the Ethereum 2.0 upgrade, which aimed to transition the network from a proof-of-work to a proof-of-stake consensus mechanism, enhancing scalability and security.

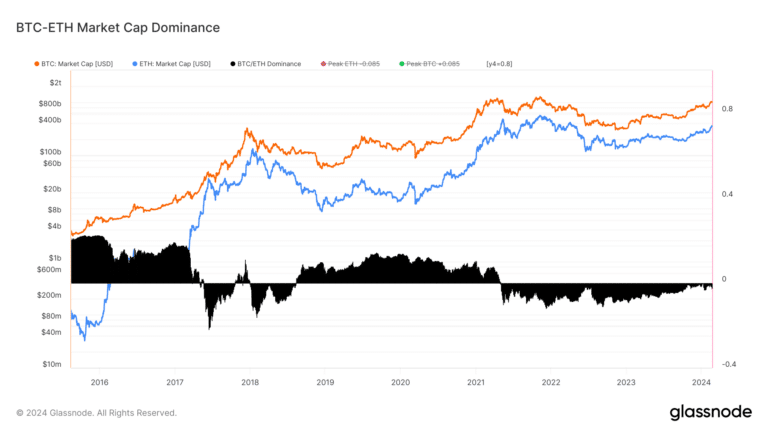

Compared to other major cryptocurrencies, Ethereum’s performance has been relatively strong, often outpacing Bitcoin in terms of percentage gains during bullish market cycles.

Technical Analysis of ETH/USD

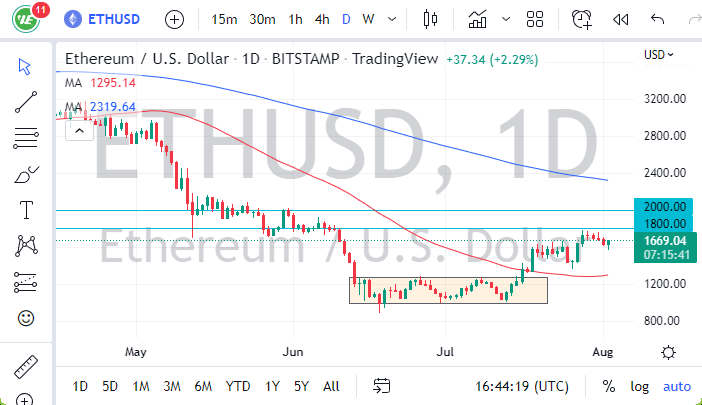

Technical analysis plays a vital role in forecasting ETH/USD trends. Traders often utilize various indicators such as Moving Averages, Relative Strength Index (RSI), and MACD to predict future price movements. In recent ETH/USD price charts, notable patterns like head and shoulders and double bottoms have emerged, signaling potential reversal points.

| Support Level | Resistance Level |

|---|---|

| $1,800 | $2,000 |

| $1,700 | $2,250 |

| $1,500 | $2,500 |

Fundamental Factors Impacting ETH/USD

The Ethereum network undergoes regular upgrades that significantly impact its market price against the USD. For instance, the transition to Ethereum 2.0 is expected to enhance transaction throughput and decrease energy consumption, potentially leading to higher valuations. Additionally, regulatory developments, such as the SEC’s stance on cryptocurrencies, heavily influence market dynamics.Major economic indicators that may influence ETH/USD include:

- Interest rates set by central banks

- Inflation rates

- Employment data

- Global economic growth rates

Market Sentiment and ETH/USD

Market sentiment is often gauged through various sentiment analysis tools that track social media trends and trading behaviors, significantly impacting ETH/USD pricing. Positive sentiment can lead to increased buying pressure, while negative sentiment may trigger sell-offs.Recent sentiment analysis results indicate a growing bullish outlook for Ethereum, with social media platforms witnessing a surge in positive discussions surrounding Ethereum’s technology and potential applications.

This heightened interest can lead to substantial price movements, reflecting the influence of market sentiment on Ethereum’s valuation.

Forecasting Methods for ETH/USD

Traders utilize various forecasting models to predict ETH/USD price movements. Common methods include Technical Analysis, Fundamental Analysis, and Sentiment Analysis. Each method has its pros and cons, with technical analysis providing short-term insights while fundamental analysis offers a broader perspective based on market conditions.

| Forecasting Method | Accuracy | Usability |

|---|---|---|

| Technical Analysis | High | Easy |

| Fundamental Analysis | Moderate | Moderate |

| Sentiment Analysis | Variable | Easy |

Risk Management in Trading ETH/USD

Effective risk management strategies are crucial when trading ETH/USD. Traders are encouraged to implement stop-loss and take-profit strategies to mitigate potential losses. For instance, setting a stop-loss at a predetermined level can help protect investments during market downturns.Additionally, portfolio diversification is essential for investors looking to minimize risk while trading ETH/USD. By spreading investments across different assets, traders can reduce their exposure to volatility associated with any single cryptocurrency.

Future Trends in the ETH/USD Market

Predictions for Ethereum’s growth suggest a continued upward trajectory, potentially increasing its valuation against USD. As more businesses adopt Ethereum’s blockchain for various applications, demand for ETH is expected to rise.Emerging technologies such as Layer 2 solutions and interoperability protocols may further enhance Ethereum’s scalability and usability, positively impacting the ETH/USD dynamic. However, potential challenges facing Ethereum in the near future include regulatory scrutiny and competition from other blockchain platforms.

- Increased regulatory oversight

- Technological competition from other blockchains

- Market volatility affecting investor confidence

Wrap-Up

In conclusion, the eth usd crypto market forecast reveals a tapestry woven with both challenges and opportunities. As Ethereum continues to innovate and adapt, understanding its correlation with the US dollar remains crucial for anyone looking to navigate this vibrant market. Stay informed, stay strategic, and let the forecast guide your next moves.

FAQ Corner

What is the current trend for ETH/USD?

The current trend for ETH/USD can vary, but ongoing analyses indicate a mix of bullish and bearish signals influenced by market sentiment and technical indicators.

How often should I check ETH/USD forecasts?

It’s advisable to check ETH/USD forecasts regularly, especially if you’re actively trading or making investment decisions, to stay updated on rapid market changes.

What factors can cause ETH/USD prices to fluctuate?

Factors such as economic developments, regulatory changes, and significant market events can lead to fluctuations in ETH/USD prices.

Is technical analysis better than fundamental analysis for forecasting ETH/USD?

Both technical and fundamental analysis have their merits; the best approach often combines elements of both to gain a comprehensive view of the market.

What should new traders focus on with ETH/USD trading?

New traders should focus on understanding market trends, using risk management strategies, and staying informed about news that might affect the crypto market.