Ethereum bitcoin price in india sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

The cryptocurrency market in India is experiencing dynamic shifts, particularly with Ethereum and Bitcoin leading the charge. Recent trends indicate intriguing price fluctuations, influenced by various market factors and regulatory developments. By understanding the current landscape, investors can navigate the complexities of this digital currency space more effectively.

Current Trends in Ethereum and Bitcoin Prices in India

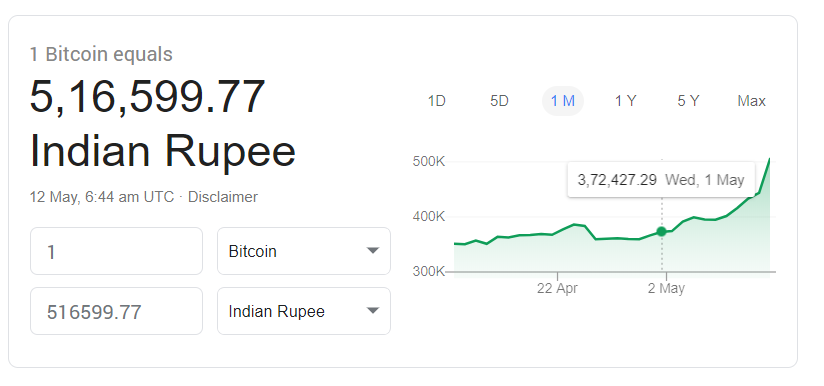

Recent trends in the prices of Ethereum and Bitcoin in India have showcased significant volatility, reflecting broader global market patterns. As of the latest data, Bitcoin’s price has fluctuated between ₹3,000,000 and ₹3,500,000, while Ethereum has seen movements between ₹200,000 and ₹250,000. These shifts are influenced by various economic and regulatory factors, as well as changes in investor sentiment. The price fluctuations can be attributed to several key influences:

- Global economic indicators, including inflation rates and interest hikes.

- Sentiment driven by news cycles related to cryptocurrency regulations.

- Market speculation and investor behavior driven by social media trends.

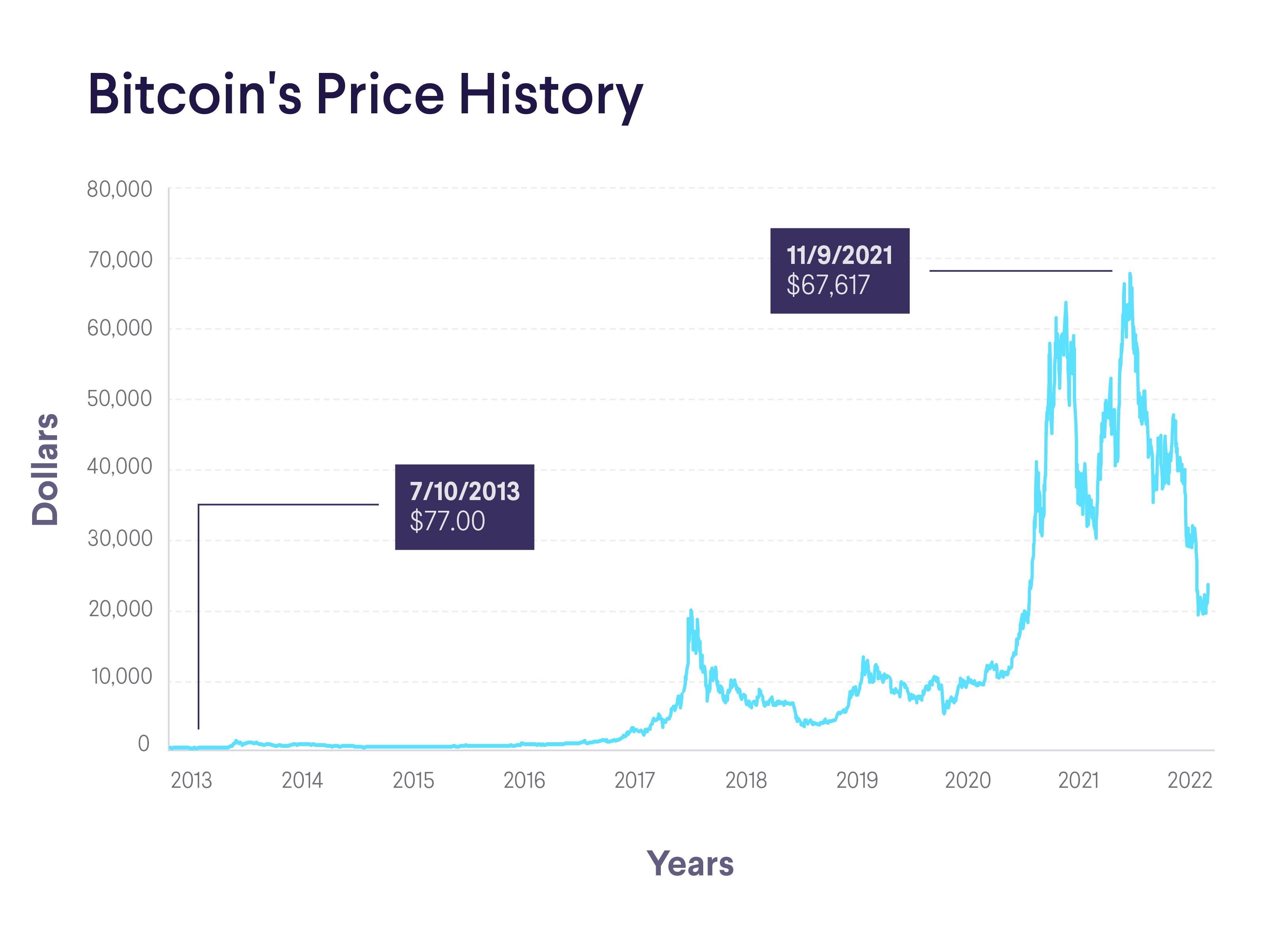

Historically, both cryptocurrencies have shown considerable price movements in the Indian market. For instance, in the past six months, Bitcoin’s price increased by approximately 25%, whereas Ethereum exhibited a growth of about 30%.

Comparison of Ethereum and Bitcoin Prices

In comparing the current prices of Ethereum and Bitcoin in India, it’s evident that both cryptocurrencies cater to different investor profiles. As of this month, Bitcoin is trading at around ₹3,200,000, while Ethereum is at ₹210,000. This marks a stark difference in pricing, reflecting the varying levels of market adoption for each cryptocurrency.To illustrate the percentage difference in price over the last month, the following table provides a clear comparison:

| Cryptocurrency | Price Last Month (₹) | Current Price (₹) | Percentage Change |

|---|---|---|---|

| Bitcoin | ₹3,100,000 | ₹3,200,000 | +3.23% |

| Ethereum | ₹200,000 | ₹210,000 | +5.00% |

While both cryptocurrencies have shown positive growth, Ethereum has demonstrated slightly more stability in pricing compared to Bitcoin over the past month.

Impact of Government Regulations on Cryptocurrency Prices

The Indian government has recently introduced several regulations surrounding cryptocurrencies, which have had a tangible effect on market prices. These regulations aim to create a more secure trading environment while also looking to tax crypto earnings.Market sentiment is heavily influenced by regulatory news. When favorable regulations are announced, there tends to be an increase in prices as investors gain confidence.

Conversely, negative news can lead to sell-offs.Significant regulatory announcements impacting prices include:

- New tax regulations on cryptocurrency transactions.

- Proposed bans on certain types of cryptocurrency trading.

- Clear guidelines on Initial Coin Offerings (ICOs).

Market Analysis of Ethereum and Bitcoin in India

Analyzing the trading volumes of Ethereum and Bitcoin on Indian exchanges provides insight into their adoption rates. Currently, Bitcoin holds a significant market share, accounting for around 60% of the total cryptocurrency trading volume in India, while Ethereum comprises approximately 25%.Major exchanges facilitating transactions of these cryptocurrencies include:

- WazirX

- CoinDCX

- ZebPay

The demographic profile of investors indicates a growing interest from younger populations, particularly those aged 18-35, who are increasingly viewing cryptocurrencies as viable investment options.

Future Predictions for Ethereum and Bitcoin Prices

Experts are predicting that the prices of both Ethereum and Bitcoin could experience substantial growth in the coming months. Factors such as increasing institutional adoption and advancements in blockchain technology are seen as potential catalysts for price appreciation.Emerging trends that could influence future price movements include:

- Enhanced adoption of decentralized finance (DeFi) applications.

- Increased investor education regarding cryptocurrencies.

- Global economic recovery post-pandemic.

The following table summarizes various analysts’ price predictions for the upcoming months:

| Analyst | Bitcoin Price Prediction (₹) | Ethereum Price Prediction (₹) |

|---|---|---|

| Analyst A | ₹3,600,000 | ₹250,000 |

| Analyst B | ₹3,800,000 | ₹275,000 |

| Analyst C | ₹4,000,000 | ₹300,000 |

Investment Strategies for Ethereum and Bitcoin

For those looking to invest in Ethereum and Bitcoin in the Indian market, effective strategies can make a significant difference. Successful investors often employ a combination of market analysis and risk management techniques.Key investment strategies include:

- Diversifying portfolios to mitigate risks associated with volatility.

- Setting clear buy and sell targets based on market analysis.

- Regularly updating knowledge on market trends and regulatory news.

Risk management techniques specific to cryptocurrency investments involve:

- Using stop-loss orders to prevent significant losses.

- Avoiding impulsive trading based on market hype.

- Engaging in dollar-cost averaging to build positions gradually.

New investors should adhere to these do’s and don’ts:

- Do conduct thorough research before investing.

- Do not invest more than you can afford to lose.

- Do stay updated with market trends.

- Do not fall for scams or fraudulent schemes.

Cultural and Economic Factors Influencing Cryptocurrency Investments in India

Cultural perceptions of cryptocurrencies play a crucial role in their adoption in India. Many young Indians view cryptocurrencies as a modern investment avenue, influenced by global trends and tech innovations. Conversely, some skeptics remain wary of the volatility and regulatory uncertainties surrounding digital currencies.Economic factors contributing to the growing interest in Ethereum and Bitcoin include a rise in disposable income, increased internet penetration, and a shift towards digital financial solutions.Key demographics contributing to cryptocurrency investments in India include:

- Tech-savvy millennials and Gen Z.

- Urban professionals seeking alternative investment opportunities.

- Investors looking for hedges against inflation.

Summary

In summary, the evolving scenario of Ethereum and Bitcoin prices in India reflects broader economic and cultural shifts, presenting both challenges and opportunities for investors. As we look ahead, staying informed on market trends and regulatory changes will be vital for making sound investment decisions.

Commonly Asked Questions

What factors influence Ethereum and Bitcoin prices in India?

Factors include market demand, regulatory news, investor sentiment, and global economic conditions.

How do government regulations affect cryptocurrency prices?

Government regulations can create uncertainty or confidence, directly impacting market prices and investor behavior.

What is the current price comparison between Ethereum and Bitcoin?

Ethereum and Bitcoin prices can vary; currently, Bitcoin tends to be more expensive, but Ethereum often shows higher percentage gains.

What are effective investment strategies for cryptocurrencies?

Diversifying your portfolio, setting clear investment goals, and understanding risk management techniques are crucial strategies.

Who are the primary investors in Ethereum and Bitcoin in India?

The demographic includes young tech-savvy individuals, millennials, and a growing number of institutional investors.